Bank Gold Accounts

Many banks now aim to collect more deposits by offering their customers a GOLD ACCOUNT alternative alongside their TL, USD and EURO accounts.

To achieve this goal, banks open gold accounts directly to their customers, allowing them to convert existing assets in TL or foreign deposits to gold and store them in gold account.

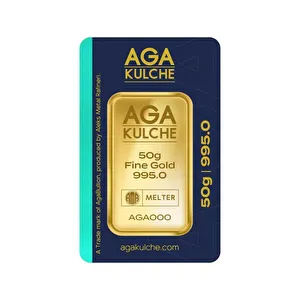

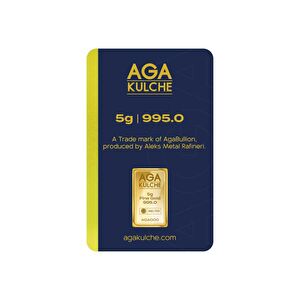

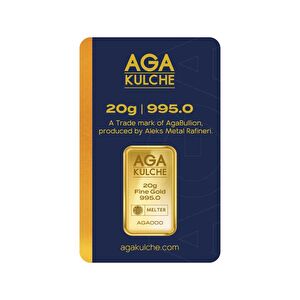

In addition, existing banks collaborate with refineries to prepare projects to bring idle gold under the pillow into the economy and convert customers‘ gold into 24-karat (995/1000) gold with certain purchasing systems and evaluate the provisions in gold accounts.

The point here is: enabling the client to benefit from the financial return of its gold in market conditions by indexing it below customer savings with existing gold accounts.

Bank gold accounts offer the ease of storing the classic method based on the alternative of retrieving physical gold. But when you need physical gold, unfortunately, you don‘t have that possibility.

You don‘t have the opportunity to physically acquire the gold that exists in your gold account. It is possible to get your investment back into cash through the Bank‘s daily gold exchange rate. But there is no way to take advantage of free-market advantages.

The gold investor can make the investment choice in light of this information.