Investing Gold

Our golden gift-giving behaviors, which begin with childbirth, continue for life in many ways, including circumcision, engagement, marriage, achievement rewarding, etc. In fact, the underlying reason for all of this is because of the behavior of investing and accumulating. It has become a habit for people of Mediterranean geography to save some of their earnings because they are anxious societies to come to, and the most preferred form of valuation of these savings has been with gold products.

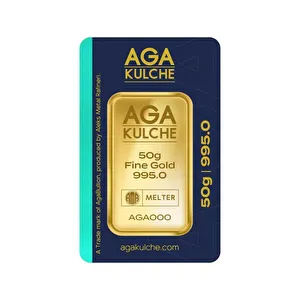

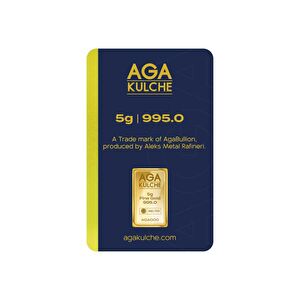

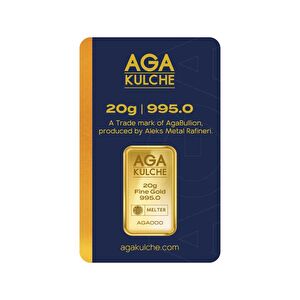

I think the fact that we are an inflationary country has the most significant impact on that. To be clear, 14 and 18 settings are made for jewelry and are inappropriate to take as investments. It can maintain gold value in these products over time, but the return on investment is low compared to other investment products due to the labor costs initially given. When it comes to investing gold, 24 (995/1000) setting products should come to mind. With each adjustment rating down from 24 settings, the investment value of the product decreases, the jewelry value and the amount of labor increases.

Even mint production trappings and coin group products are preferred in second place as they contain labor compared to 24-carat products.

In our country, where there is estimated to be five thousand tons of gold under the pillow, the proper planning of these investments will mean more accurate use of both personal budgets and the country‘s budget.