The battle continues: Inflation vs Central Banks

Gold Price Outlook

While gold has continued to hover around $1850/oz this month, the yellow metal has continued to defy the expectations of more bearish investors. As promised, the FED increased policy rates from 4.50% to 4.75%. While an increase of just 25 basis points could be seen as a sign that the Fed is slowing down, it‘s important to remember that just a year ago the official rate was just 0.25%.

The Federal Reserve partially softened its rhetoric, stating that only a few more rate hikes would be needed to keep inflation under control, but once again emphasized that rates will be kept high until inflation is fully under control. This means that it will take time for interest rates to catch up with inflation and therefore support gold for a longer period of time.

It is estimated that the inflation rate in the USA, currently 6.3%, will decrease slightly to around 6.2%. However, it is important to note that US inflation is still higher than the levels reached during the 2008 financial crisis, and rates are still more than 1% lower than official inflation figures. Gold still has time to shine, but may enter a slow but steady decline from its highs over time.

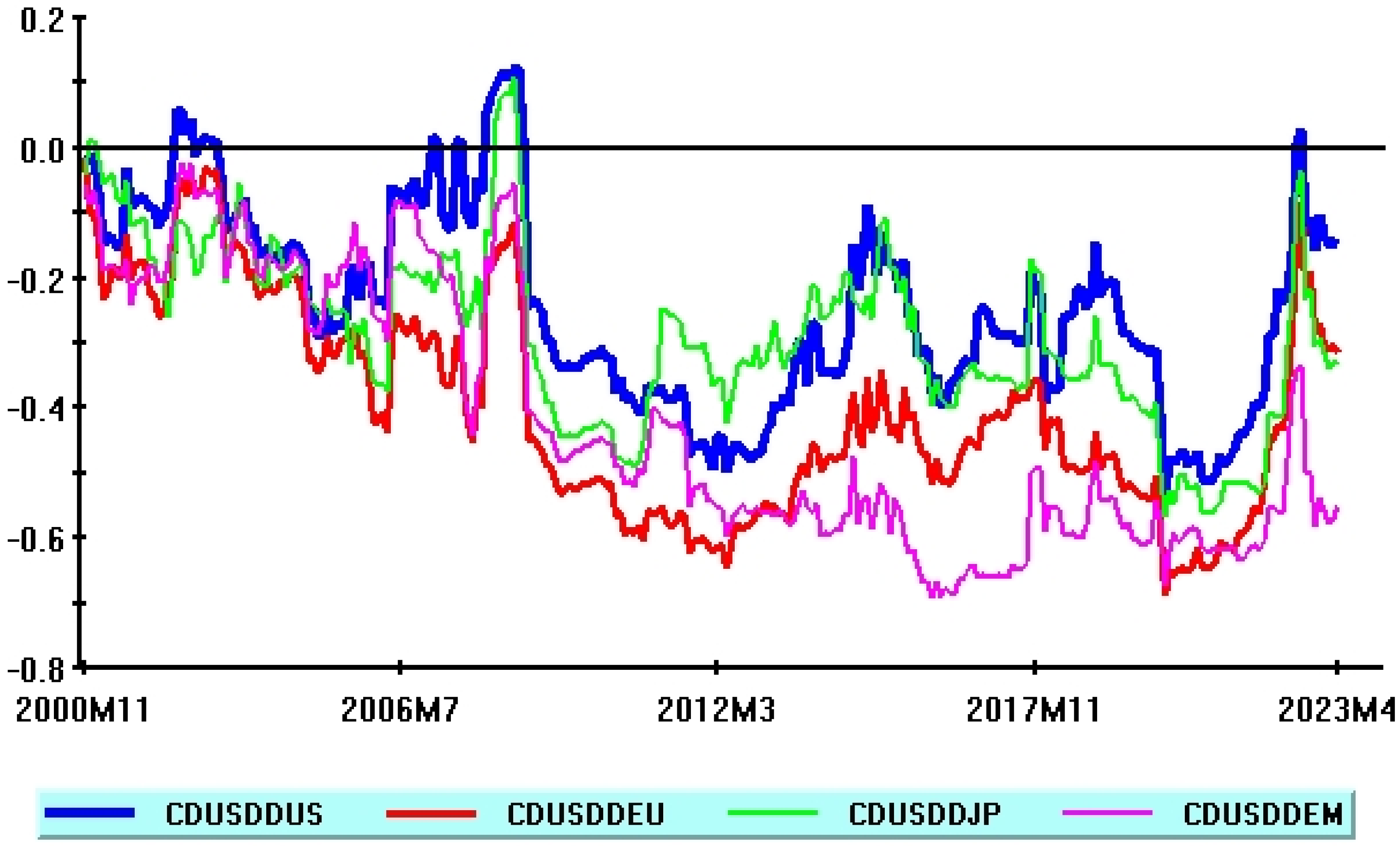

Source Trading Economics

US Inflation Rates 2000-2023

European Inflation Data

Last week, the latest inflation data in Europe was announced, showing that annual inflation decreased from 8.6% to 8.5%. However, core inflation continued to rise, reaching 5.6% in February, up 0.30% compared to last month. In line with expectations, the ECB increased interest rates by 50 basis points to 2.5%.

The EU could not be as hawkish as the USA and lagged behind in increasing interest rates. The additional pressure created by the energy sanctions imposed on Russia also played a role in the high inflation rate, and this situation will continue for a longer period compared to the USA. Germany reported that its inflation rate reached 9.3%; However, the effects of the embargo on Russian hydrocarbons were not as devastating as previously thought.

Europe has almost survived the winter; but next winter may have a more serious impact than the current winter. The EU‘s storage capacity is down to 60-65% of its total capacity, and it is not certain that LNG terminals will be able to come online next winter. Overall, the EU is struggling with higher levels of inflation than the US, but has nevertheless fallen seriously behind in raising policy rates.

Source: Eurostat Eurostat / Trading Economics

First Anniversary of the War in Ukraine

On February 24, 2022, Russian forces entered Ukraine and began their occupation, which has so far cost the lives of tens of thousands of people, civilians and military. Although incomparable to the human toll, the economic impacts were enormous. While Russia remains fully sanctioned by the West, damage in Ukraine has reached tens of billions of US dollars.

After Russia‘s lightning advance in the first few weeks of the war, the conflict turned into a bitter war of attrition similar to the trench warfare of the First World War. Western aid to Ukraine has increased dramatically, with the USA alone providing approximately 76 billion USD in aid. All-out sanctions against Russia also had a significant impact on the precious metals sector, and the import of Russian gold, which constitutes 10% of the gold mined in the world every year, by Western companies completely stopped.

A final interesting point regarding the precious metals sector is Russia‘s increasing cooperation with South Africa. Together, the two countries supply almost 80% of the world‘s palladium supply and therefore have significant control over the autocatalyst production sector. While everyone, Western and Russian, is adapting to the new normal, there seems to be no clear end in sight for the war.

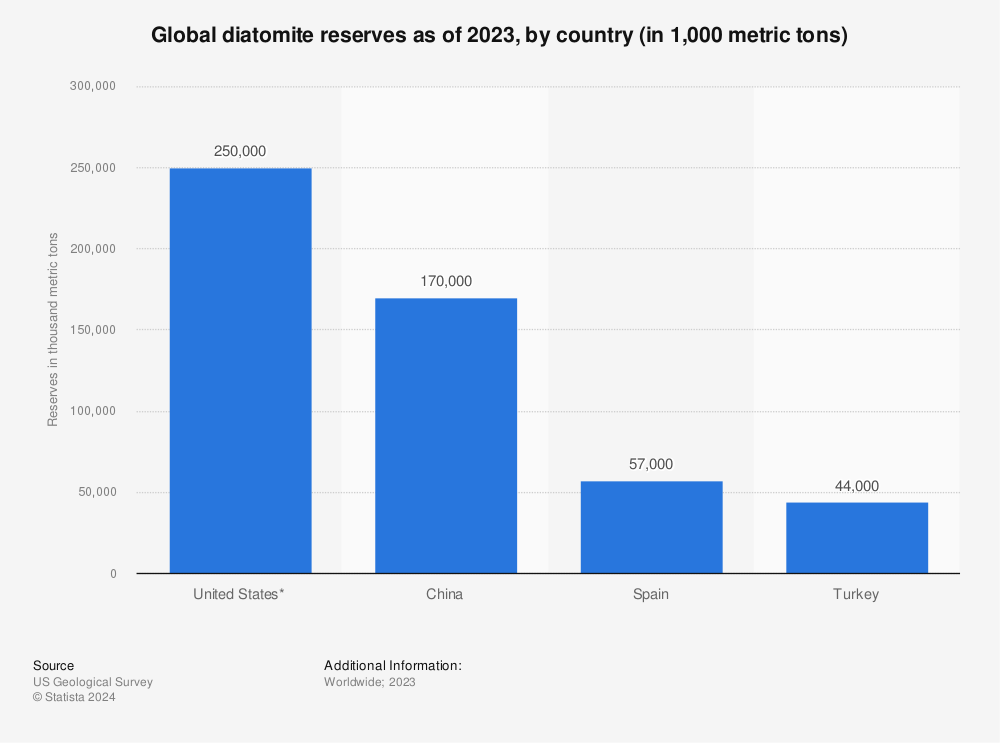

Source: US Geological Survey / Statista

Status of Turkish Economy

Turkey‘s latest inflation figures have been announced and are officially 3.5% monthly and 70% annually, respectively. An independent inflation research group called ENAG announced a monthly rate of 5% and an annual rate of 120%, respectively. Although inflation has slowed slightly, it is still staggering even when compared to the EU or the rest of the developing world.

The country‘s external account deficit has widened tremendously, rising from USD 10 billion to USD 14 billion in January this year, an increase of 40% compared to January last year. As a result, the government introduced a number of restrictions on trade and currency exchange, which also affected the international bullion trade.

The critical election in which President Erdoğan will run for a third term in one of the most contentious elections of recent decades is expected to be held on May 15. There was a large coalition of opposition parties running under a unified platform, threatening Erdogan‘s electoral prospects. However, this fragile alliance fell apart last week when the second largest party of the 6-party coalition left the agreement.

Source: bne.IntelliNews

Additional Short News:

In Nigeria, Africa‘s largest democracy, an election was held this month to elect the president. One of the traditionally dominant parties won the election with almost 37% of the vote, but two other major candidates are contesting the result. It remains to be seen whether any of these can solve Nigeria‘s numerous problems.

The UK and the EU have reached another agreement aimed at resolving the Northern Ireland crisis caused by the current Brexit arrangement. Both sides hope this deal will reduce trade frictions between the UK and Northern Ireland and help improve strained relations. What is important here is that both parties act constructively towards each other, which is a positive sign for the economies of both parties.